| |

In the modern economy

individuals and businesses pay for products and services using different

forms of payments. These come in the form of a pay now or pay later

method.

Traditional pay now

methods include paper money of that particular government (example, US

Dollar), debit card, check, alterative payment apps, or bank wire

for larger purchases where the money is changed in real time from buyer

to seller.

Traditional pay later methods include credit cards, installments such as

car payments, mortgages, other loans, and lines of credits for personal

and business use from different institutions.

Both methods

are a form of an IOU (I Owe You) because products and services

are being exchanged for a form of US Dollars. Does not

matter the particular bill's ($1, $2, $5, $10, $50, or $100)

or coin's (1, 5, 10, 25, or

50) stored value because the actual money being exchanged

is an IOU to use anywhere else in the economy at a later

time.

The

US Government writes on all paper money "THIS NOTE IS LEGAL

TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE" which means the

dollar is an IOU of the US government. The

US Government writes on all paper money "THIS NOTE IS LEGAL

TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE" which means the

dollar is an IOU of the US government.

It is not the money itself that

creates the value, because the value of the money is not

backed by any collateral anymore. Before 1971, paper money

was backed by Gold, so the government could only print based

on their Gold reserves at Fort Knox (because paper money

could be convertible into gold). Nowadays, money is

just paper, that when the government wants to print more and

needs more money it can do that at any time. In essence the

only reason that money is worth anything is because all the

people in society accept it's stored value and carry it's

worth in exchange for products and services.

The Fed (also known as Federal

Reserve System) is the central bank of the US comprised of

12 different Federal Reserve Banks around the country, owned

by big private banks and operates relatively independent of

government. The US government when it needs more money in

the economy it borrows money by issuing bonds and then

orders the central bank to buy those bonds by printing

money. This means that every dollar that the government

prints it has to pay interest on that money.

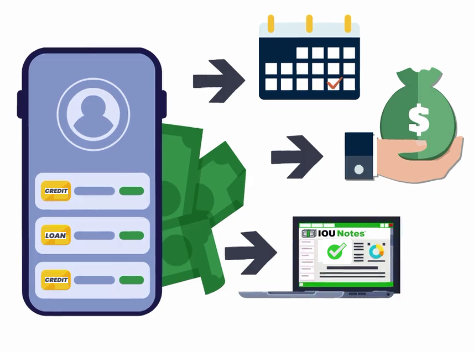

The IOU Notes™

platform focuses on the pay later

method.

The term

IOU (I Owe You) has a history dating to the 18th century. It is often

viewed as an informal written agreement

acknowledging debt.

People have been

providing credit, borrowing, and lending to each other since the

beginning of time. While this concept is not new, IOU Notes created a

platform (patent pending) where transactions can safety and easily take

place, be tracked, etc. in one convenient platform. Every account

created must be a real person or business entity and go through a

verification process by uploading the proper form of identification.

Profiles can be set to public where everyone can see or private mode so

just the individuals and businesses that are working together can see. The IOU Notes™

platform focuses on the pay later

method.

The term

IOU (I Owe You) has a history dating to the 18th century. It is often

viewed as an informal written agreement

acknowledging debt.

People have been

providing credit, borrowing, and lending to each other since the

beginning of time. While this concept is not new, IOU Notes created a

platform (patent pending) where transactions can safety and easily take

place, be tracked, etc. in one convenient platform. Every account

created must be a real person or business entity and go through a

verification process by uploading the proper form of identification.

Profiles can be set to public where everyone can see or private mode so

just the individuals and businesses that are working together can see.

An example

of an IOU in someone's personal life is when a person borrows money from family, friends,

and others in an informal way and writes an IOU (I Owe You) note. It is with the intention to pay back but

a lot of times either people start asking for the money back, or are too

embarrassed to ask, or the person does not pay back and it creates

tensions in the relationship. There are many

situations where individuals need to borrow money to

either pay for immediate expenses (food, rent/mortgage, child expenses,

family expenses, etc.)

Current options to borrow are from banking and lending

institutions who charge high interest rates. Some credit cards offer

zero or low interest rates for a time period but then afterwards

interest rates spike up as much as 29% APR (annual percentage rate) plus

late and other fees. Then there are Payday loan companies that people

use for short tem loans which can add up to over 400% APR or

more when it is finally paid back. These credit cards and

loan companies lure people into their

trap knowing that there will be many people who fall into this interest

trap. Once in debt it is hard to get out. IOU Notes platform interest

rate is set by users (from no interest - 5% max).

An example

of an IOU in the marketplace is as follows. Say ABC Construction Company

places an order for lumber and other building materials and does not

have enough in payment (credit card, cash, check) to pay for the entire

order when it is delivered. Instead, company pays a down payment and

issues an IOU (I Owe You) promising to pay for the rest of the materials

within 30 days with or without interest. Assuming that supplier is ok

with this and has an established business relationship with ABC

Construction Company, an IOU will be accepted by both parties. Many

businesses operate on Net 30 terms which is also a form of IOU's. They

take possession of the product or utilize the service and have 30 days

to pay off the invoice. When an

individual or business starts to try to work with other vendors, that

vendor pulls their credit report to see their history and decides

whether or not to extend credit. Pulling a credit report too often has a

negative effect on that individual or business. This results in making

sense only to ask new vendors for credit on larger types of purchases,

and not small and mid size purchases.

In addition,

many service businesses

in the economy currently extend a form of IOU to their customers while

not even realizing it. There are many types of businesses that operate

this way of providing service a payment is deferred until service is

completed. This happens that same day which might be 15 minutes, 30

minutes, 1 hour, or 2 hours, etc. later when customer leaves from place

of business or service has been provided, depending on the service being

provided. These businesses operate on extending short term IOU to their

customers everyday and are not even aware that it is going on.

There are hundreds of

service business types and the majority operate on some kind of IOU,

where they provide service first and get paid after service is

completed. A few examples of these types of businesses include sit down

restaurants, bars, hair salons, dentists, auto mechanics/service shops,

home repair services, etc. Most of these businesses provide service

first to the customer and there is no credit check, identification

provided, collateral provided, or many times not even the customer's

basic information (name, address, phone number) is asked for before

service is provided. It has become standard practice in the marketplace

for most service businesses to just provide the service and the customer

will pay immediately afterwards. The IOU Platform takes this already

established practice and extends it for a longer timeframe/pay later

option and also includes this model to product based businesses and

individuals operating as sole proprietorships. There are hundreds of

service business types and the majority operate on some kind of IOU,

where they provide service first and get paid after service is

completed. A few examples of these types of businesses include sit down

restaurants, bars, hair salons, dentists, auto mechanics/service shops,

home repair services, etc. Most of these businesses provide service

first to the customer and there is no credit check, identification

provided, collateral provided, or many times not even the customer's

basic information (name, address, phone number) is asked for before

service is provided. It has become standard practice in the marketplace

for most service businesses to just provide the service and the customer

will pay immediately afterwards. The IOU Platform takes this already

established practice and extends it for a longer timeframe/pay later

option and also includes this model to product based businesses and

individuals operating as sole proprietorships.

Sign Up For

Your FREE Account and

Get Started Now!

|

|

|